Trends In Latest CoStar Composite Price Indices Show Steady Growth Continuing Through Second Quarter

CCRSI RELEASE – July 2019

(With data through June 2019)

Print Release (PDF)

Complete CCRSI data set accompanying this release

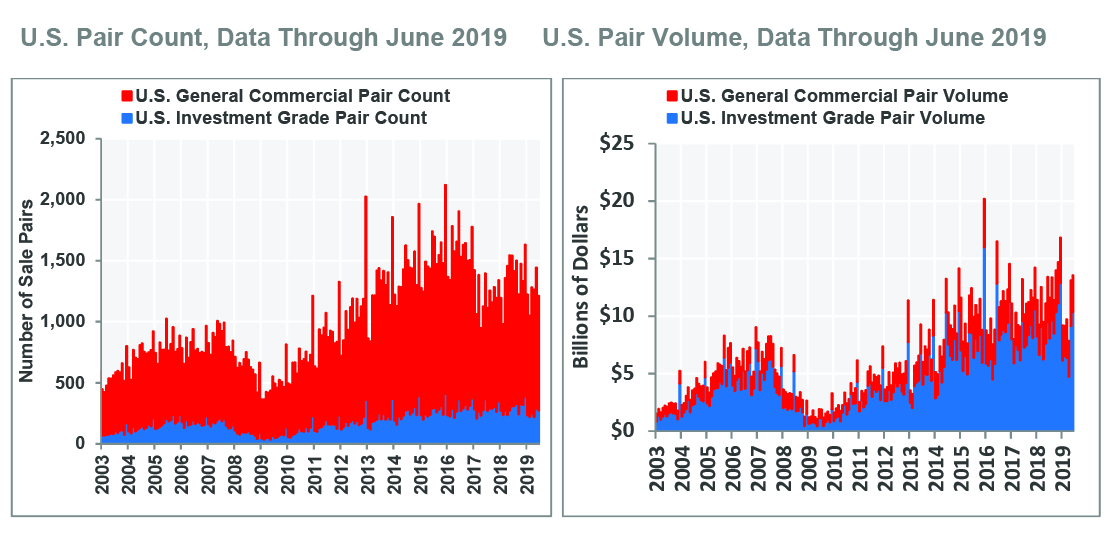

This month's CoStar Commercial Repeat Sale Indices (CCRSI) provides the market's first look at commercial real estate pricing trends through June 2019. Based on 1,213 repeat sale pairs in June 2019 and more than 212,000 repeat sales since 1996, the CCRSI offers the broadest measure of commercial real estate repeat sales activity.

CCRSI National Results Highlights

-

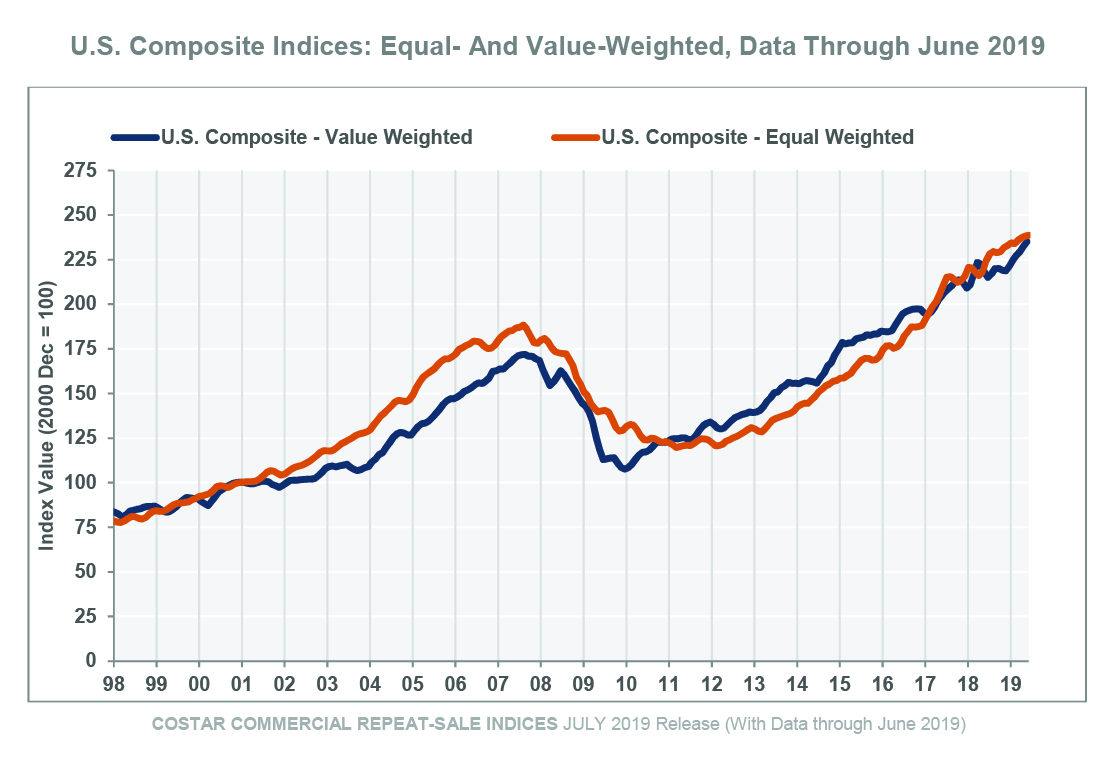

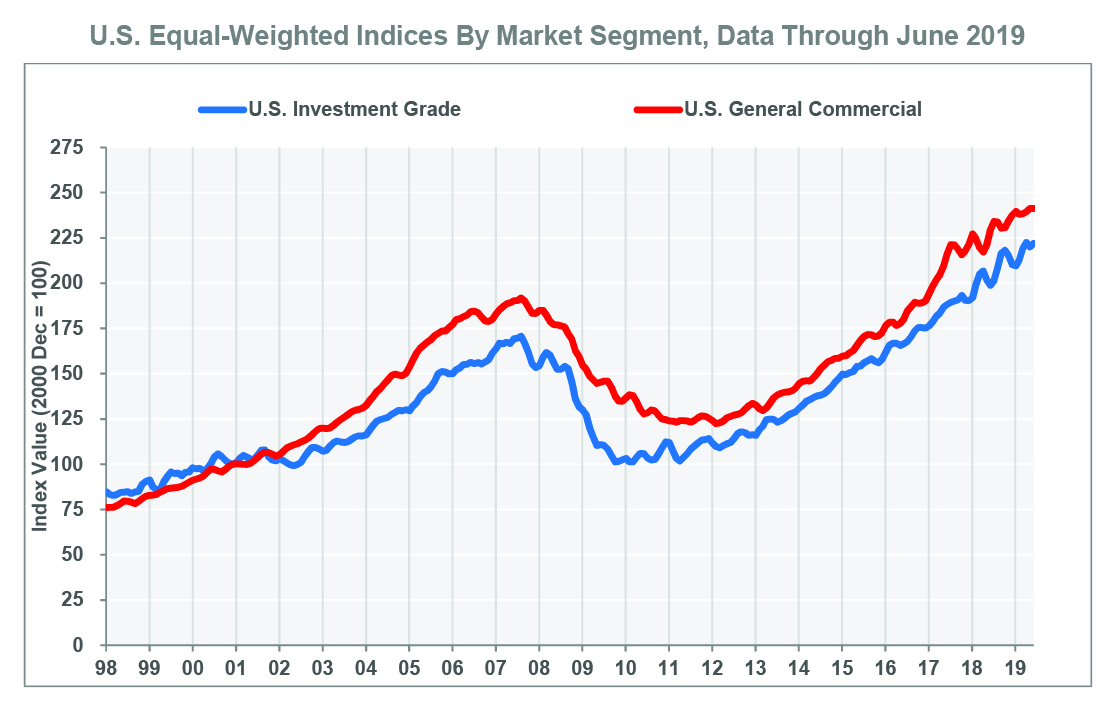

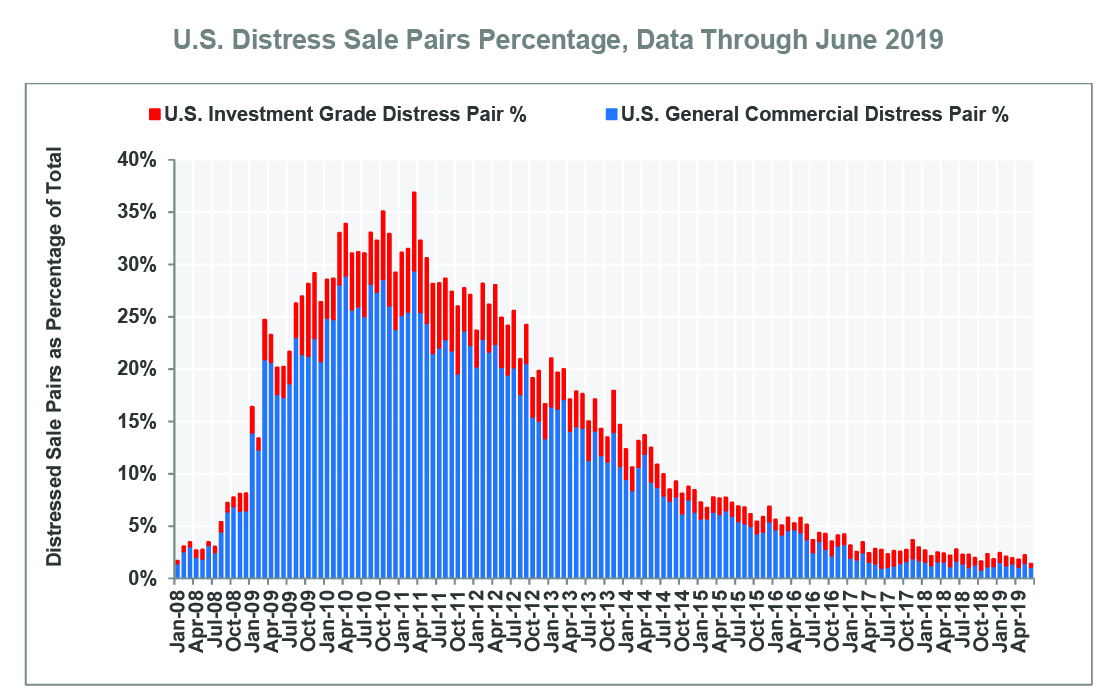

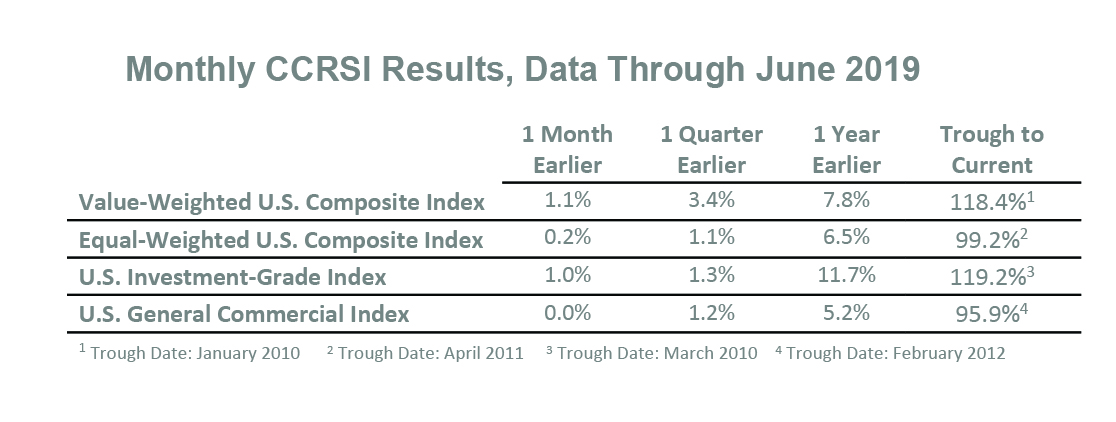

DECADE-LONG ECONOMIC EXPANSION FUELED RECORD COMMERCIAL REAL ESTATE PRICE GROWTH THIS CYCLE. The U.S. economic expansion entered its 11th year in June 2019, marking the longest in history, and also supporting record growth in commercial real estate pricing. The value-weighted U.S. Composite Index, which reflects the larger asset sales common in the core markets that led the recovery, has expanded a cumulative 118.4% since its nadir in 2010 and is now 36.7% above its prerecession peak. Meanwhile, the equal-weighted U.S. composite index, which reflects the more numerous but lower-priced property sales typical of secondary and tertiary markets, has grown a cumulative 99.2% since bottoming out in 2010 and is now 26.7% above its previous peak.

-

COMPOSITE PRICE INDICES CONTINUED RECENT GRADUAL GROWTH TREND THROUGH SECOND QUARTER. In the second quarter of 2019, the value-weighted U.S. Composite Index rose 3.4%, while the equal-weighted U.S. Composite Index was up 1.1%. Recent gains remain broad-based as both composite indices have increased by about 7% in the 12-month period ended in June 2019.

-

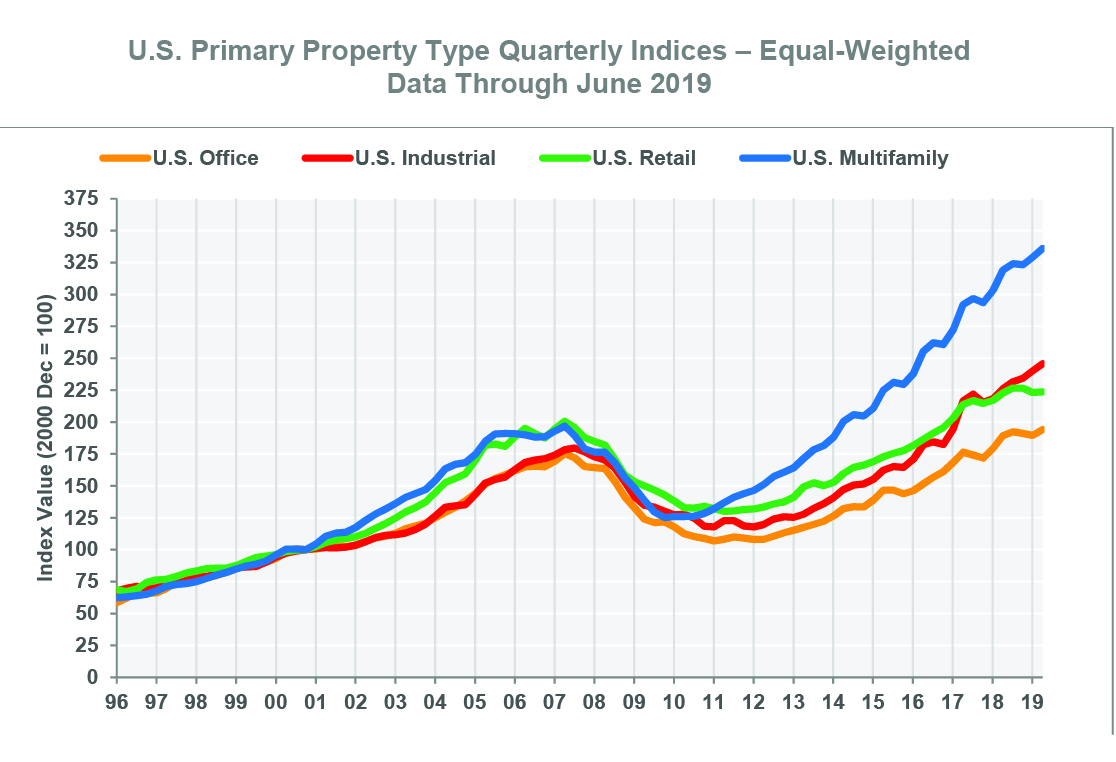

INDUSTRIAL INDEX LEADS ALL SIX PROPERTY-TYPE INDICES AS TOP PERFORMING PRICE INDEX. The consistent and robust leasing performance of industrial property has supported above-average price gains. The U.S. Industrial Index advanced 8.7% in the 12-month period ended in June 2019, which was the strongest growth rate of the 8 property type indices in the CCRSI during that time period.

-

RETAIL SECTOR HEADWINDS ACT AS A DRAG ON U.S. RETAIL INDEX PRICE GROWTH. The U.S. Retail index rose a scant 0.2% in the second quarter of 2019, and just 0.4% in the12-month period ended in June 2019, the slowest quarterly and annual rates among the four major property type indices. Given headwinds facing the sector, retail pricing has been flat overall and has even regressed in centers with elevated vacancy rates.

-

OVERALL TRANSACTION VOLUME INCREASED NEARLY 5% THROUGH JUNE. Composite pair volume of $144.5 billion in the 12-month period ended in June 2019 marked a 4.9% increase from the 12-month period ended in June 2018. The increase in sales volume was broad-based with similar increases in both the General Commercial and Investment Grade segments.

CCRSI Property Type Results Highlights

-

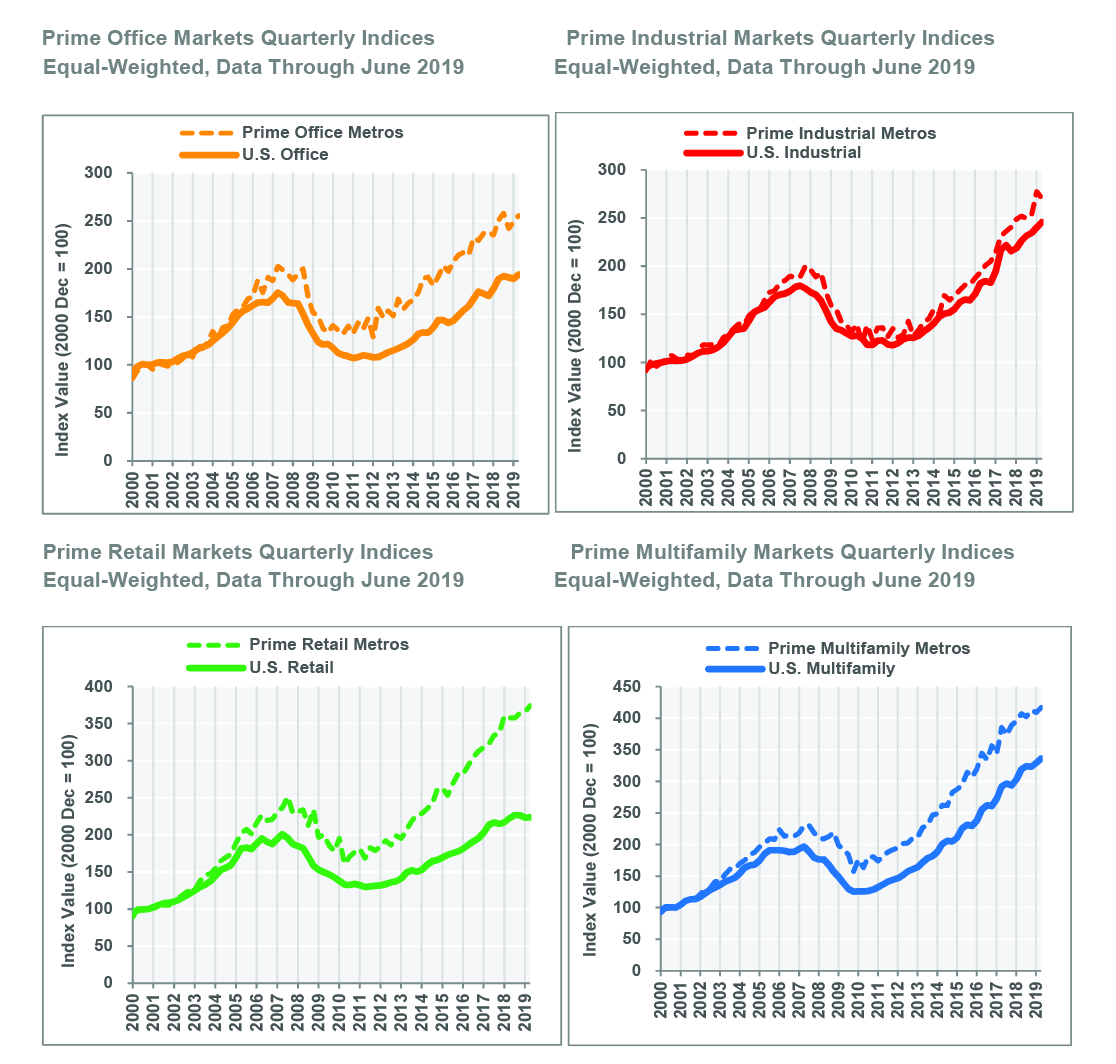

MAJOR PROPERTY SECTORS CONTINUED TO POST MODERATE GAINS IN SECOND QUARTER. The major property type indices posted average price growth of 2.2% in the second quarter, with the exception of the retail index, which lagged at just a 0.2% growth rate. The Prime Markets Indices within each property sector, which are dominated by the large, core, coastal metropolitan areas, generally increased at a slower pace than the national property type indices, confirming that commercial property price gains have become broad-based.

-

INDUSTRIAL INDEX LED PRICING GROWTH AMONG THE FOUR MAJOR PROPERTY TYPES. Industrial fundamentals remained exceptionally healthy in the second quarter as cyclically low vacancies below 5% have driven sustained above-trend rent growth. As a result, pricing for industrial properties has increased, with the U.S. Industrial index up 2.3% in the second quarter of 2019 and 8.7% in the 12-month period ended in June 2019. Core markets remained in favor with investors as the Prime Industrial Metros Index advanced at a similar rate of 7.1% in the 12-month period ended in June 2019.

-

SOLID PRICING GAINS PERSISTED IN MULTIFAMILY INDEX. The U.S. Multifamily Index expanded 2% in the second quarter of 2019 and 5.3% in the 12-month period ended in June 2019, maintaining its position as one of the strongest property type indices this cycle. Capital continues to move out on the risk spectrum, as secondary markets see stronger pricing gains. Meanwhile, the Prime Multifamily Metros Index, which is are dominated by the large, core, coastal metropolitan areas, increased at a slower rate of 2.5% in the 12-month period ended in June 2019.

-

OFFICE PRICE GROWTH REBOUNDS IN SECOND QUARTER. The U.S. Office Index increased 2.4% in the second quarter of 2019, stemming modest declines in the previous two quarters to increase by 2.5% for the 12-month period ended in June 2019. Price growth in the Prime Office Metros Index advanced at a modestly slower pace of 1.9% in the 12-month period ended in June 2019, again reflecting investors looking beyond core markets to high-growth secondary markets in search of yield.

-

RETAIL PRICING REMAINS RELATIVELY FLAT. The U.S. Retail index rose just 0.2% in the second quarter and 0.4% in the 12-month period ended in June 2019, the slowest quarterly and annual rates among the four major property type indices. The bifurcation in retail property performance translates to the investment market as well. Good quality, well-located retail continues to command investor interest and pricing growth, while pricing is regressing in centers with elevated vacancy rates. The Prime Retail Metros Index advanced by a solid 4.6% in the 12- month period ended in June 2019, suggesting that solid retail locations in core markets remain in favor.

-

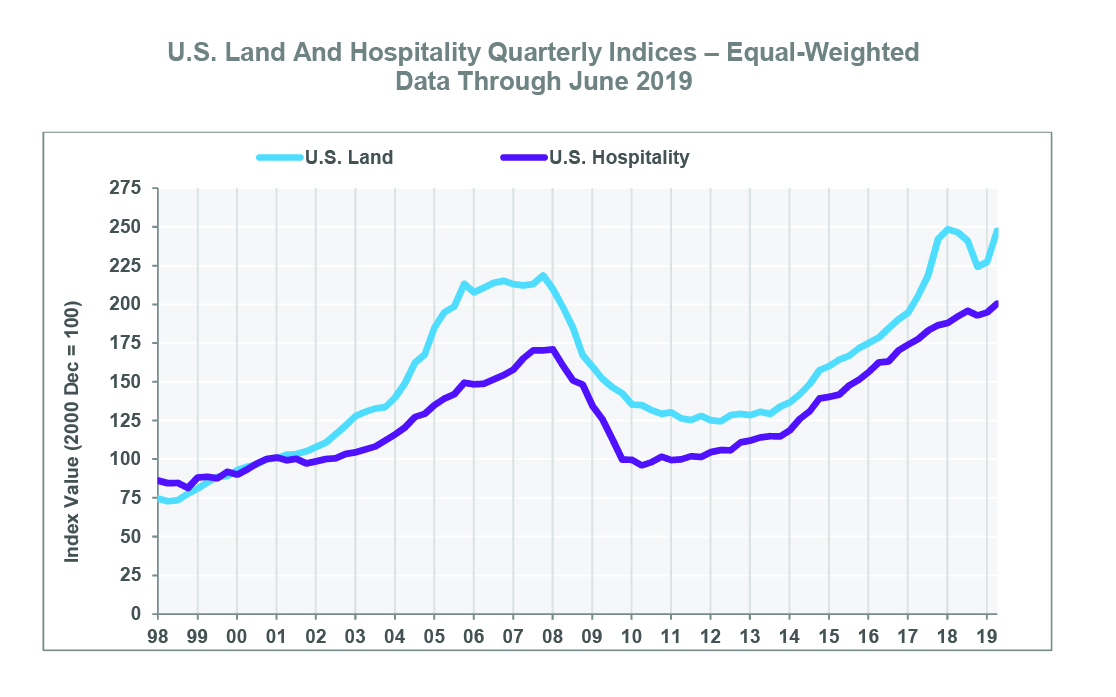

U.S. HOSPITALITY INDEX SEES STEADY GROWTH. The U.S. Hospitality Index was up 2.9% in the second quarter of 2019, contributing to annual gains of 4.3% in the 12-month period ended in June 2019. Demand for hotel rooms remains in solid shape as national hotel occupancies are well above average and revenue per available room (RevPAR) growth continues. Hotel properties continue to command high prices as the U.S. Hospitality Index reached 17.3% above its prerecession peak as of the second quarter of 2019.

-

U.S. LAND INDEX GROWTH ENDS 12-MONTH PERIOD ON POSITIVE NOTE. The U.S. Land Index is the most volatile of the property type indices. After falling in two of the previous three quarters, the index jumped 8.8% in the second quarter of 2019, translating to an annual gain of 0.3% in the 12-month period ended in June 2019. Reflecting the continued demand for development sites, the U.S. Land Index was up 13.2% over its prior peak level as of June 2019.

CCRSI Regional Results Highlights

-

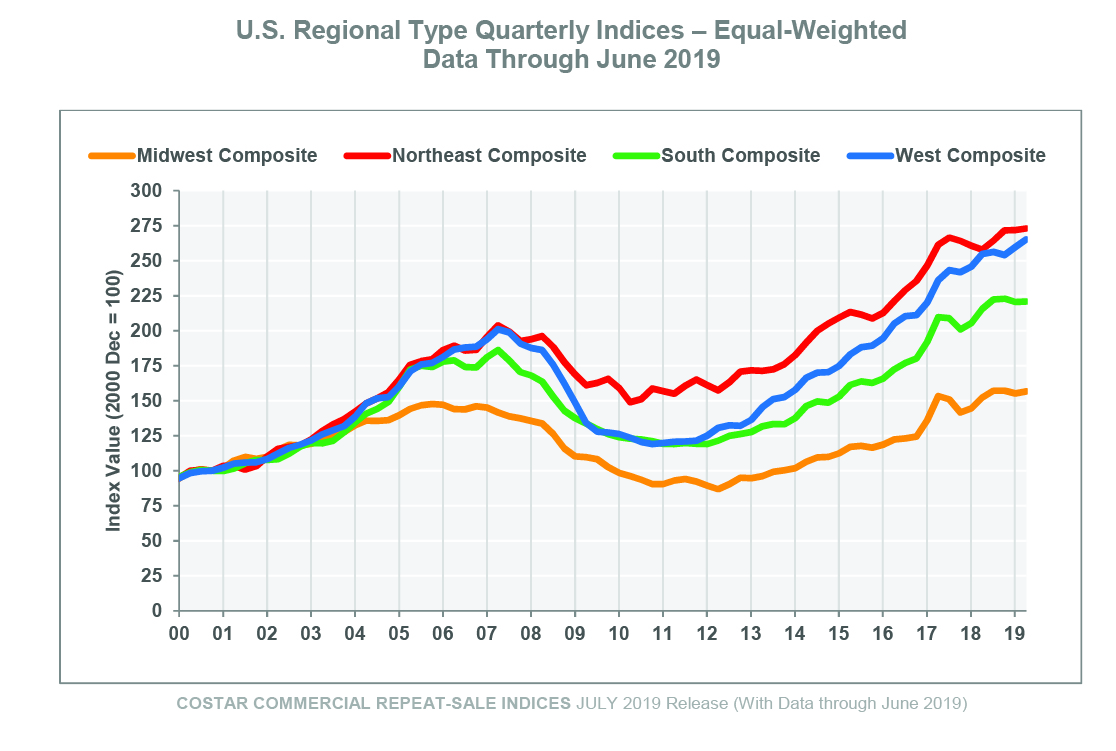

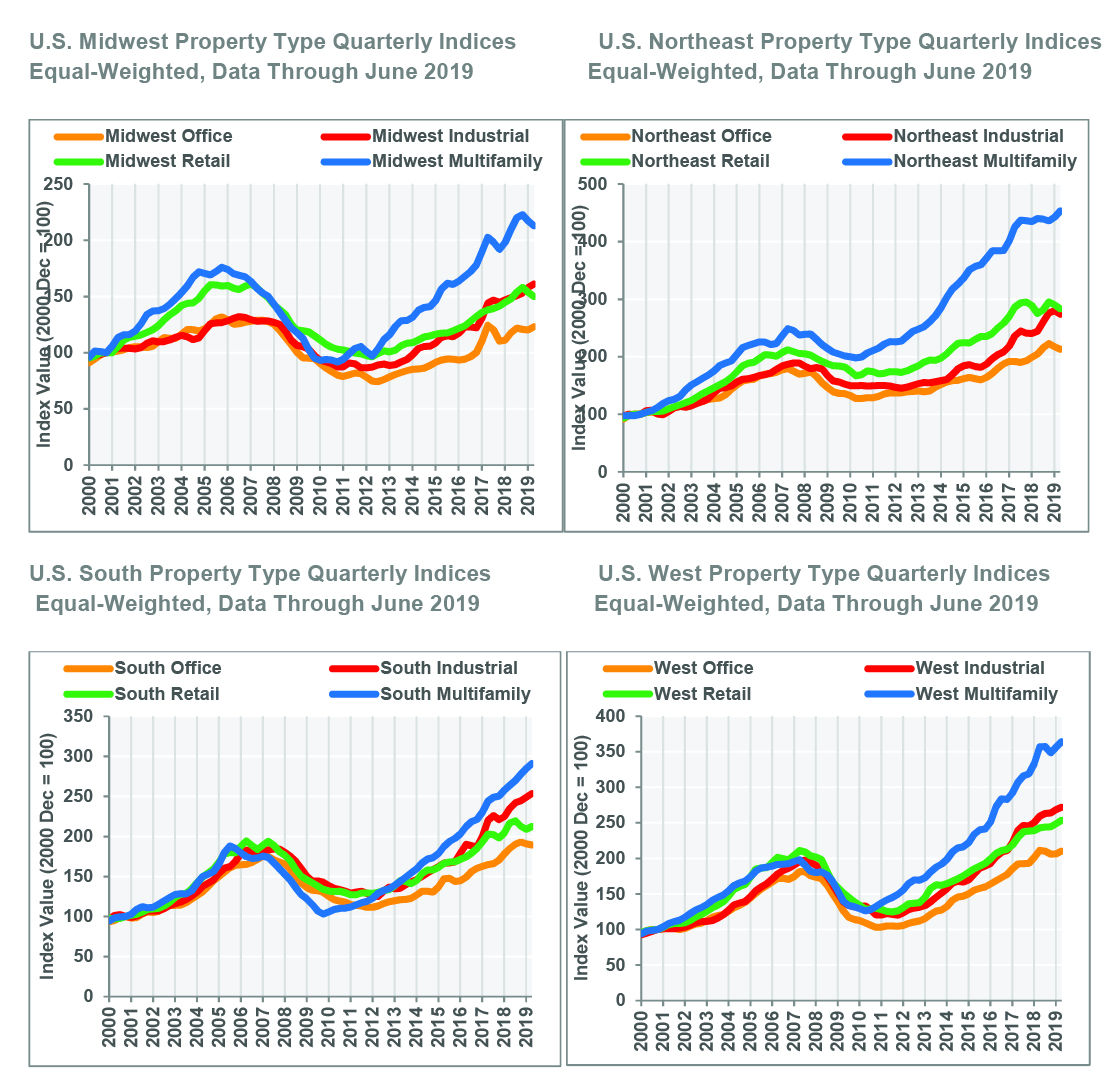

BROAD-BASED PRICING GROWTH ACROSS PROPERTY TYPES BOLSTERED WEST REGIONAL INDEX. The West Composite Index advanced 2.1% in the second quarter of 2019 and expanded 4.1% in the 12-month period ended in June 2019 to become the best performing index for quarterly growth among all the other regions. The West region has exhibited the strongest momentum recently, with positive growth across all four property types in the first two quarters of 2019.

-

MULTIFAMILY, INDUSTRIAL, SHOW STRONGEST GROWTH IN NORTHEAST. The Northeast Composite Index advanced 5.9% in the 12-month period ended in June 2019, the strongest annual growth rate among the four regions, but its outperformance was due in large part to strong growth in the Northeast Industrial Index, which was up 12.1% in the 12-month period ended in June 2019, the strongest annual growth rate among the 16 regional property type indices. Meanwhile the Northeast Multifamily Index continued to inch up, with growth of 3.1% in the 12-month period ended in June 2019, placing it 82% above its prerecession high.

-

HIGH CONCENTRATION OF FASTER-GROWING SUNBELT MARKETS LIFTS GROWTH IN SOUTH REGION. The South region exhibited solid pricing gains in the 12-month period ended in June 2019, led by double-digit gains of 10.3% in the South Multifamily Index and above-average growth of 7.8% in the South Industrial Index. The retail sector exhibited some weakness in the second quarter, which follows the national trend. A higher concentration of faster growing, low-cost metropolitan areas in the South region has bolstered both demand for commercial real estate and pricing growth.

-

WEAKNESS IN RETAIL AND MULTIFAMILY SEGMENTS BLUNTS STRONGER GROWTH IN MIDWEST REGIONAL INDEX. The Midwest Composite index edged up 2.9% in the 12-month period ended in June 2019. However, recent quarterly declines in the Midwest Retail and Multifamily indices were a drag on pricing growth, while the Midwest Industrial Index was the stand-out performer. The Midwest Industrial Index advanced 8.2% in the 12-month period ended in June 2019, the third-strongest growth rate among the 16 regional property type indices.

About The CoStar Commercial Repeat-Sale Indices

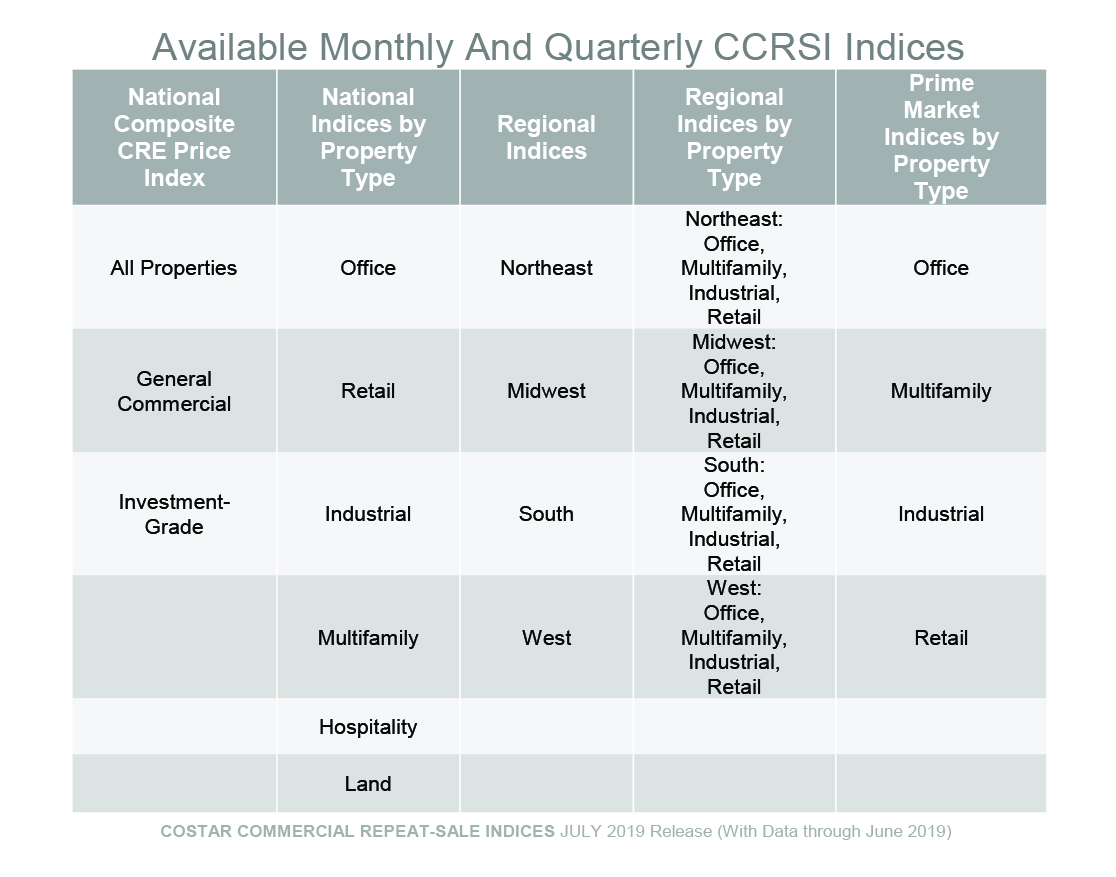

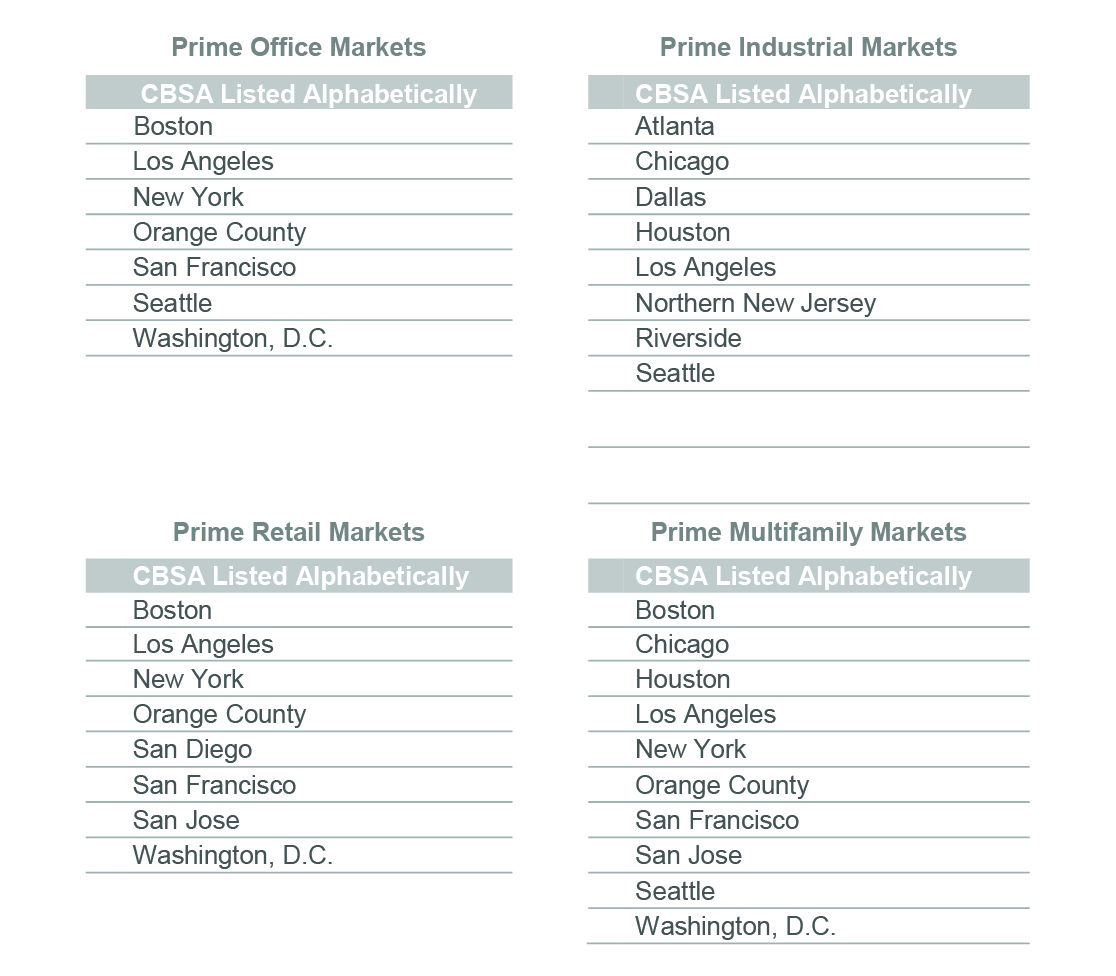

The CoStar Commercial Repeat-Sale Indices (CCRSI) is the most comprehensive and accurate measure of commercial real estate prices in the United States. In addition to the national Composite Index (presented in both equal-weighted and value-weighted versions), national Investment-Grade Index, and national General Commercial Index, which we report monthly, we report quarterly on 30 sub-indices in the CoStar index family. The sub-indices include breakdowns by property sector (office, industrial, retail, multifamily, hospitality, and land), by region of the country (Northeast, South, Midwest, and West), by transaction size and quality (general commercial, investment-grade), and by market size (composite index of the prime market areas in the country).

The CoStar indices are constructed using a repeat sales methodology, widely considered the most accurate measure of price changes for real estate. This methodology measures the movement in the prices of commercial properties by collecting data on actual transaction prices. When a property is sold more than once, a sales pair is created. The prices from the first and second sales are then used to calculate price movement for the property. The aggregated price changes from all of the sales pairs are used to create a price index.

Media Contact:

Matthew Blocher, Vice President, Marketing, CoStar Group mblocher@costar.com.

For more information about the CCRSI Indices, including the full accompanying data set and research methodology, legal notices and disclaimer, please visit https://costargroup.com/costar-news/ccrsi.

ABOUT COSTAR GROUP, INC.

CoStar Group, Inc. (NASDAQ: CSGP) is the leading provider of commercial real estate information, analytics and online marketplaces. Founded in 1987, CoStar conducts expansive, ongoing research to produce and maintain the largest and most comprehensive database of commercial real estate information. Our suite of online services enables clients to analyze, interpret and gain unmatched insight on commercial property values, market conditions and current availabilities. LoopNet is the most heavily trafficked commercial real estate marketplace online with 5.8 million monthly unique visitors. Realla is the UK’s most comprehensive commercial property digital marketplace. Apartments.com, ApartmentFinder.com, ForRent.com, ApartmentHomeLiving.com, Westside Rentals, AFTER55.com, CorporateHousing.com, ForRentUniversity.com and Apartamentos.com form the premier online apartment resource for renters seeking great apartment homes and provide property managers and owners a proven platform for marketing their properties. CoStar Group’s websites attracted an average of over 52 million unique monthly visitors in aggregate in the second quarter of 2019. Headquartered in Washington, DC, CoStar maintains offices throughout the U.S. and in Europe and Canada with a staff of over 3,900 worldwide, including the industry’s largest professional research organization. For more information, visit www.costargroup.com.