Steady as She Goes: Composite Price Indices Remain Stable at Start of Year

CCRSI RELEASE – FEBRUARY 2018

(With data through JANUARY 2018)

Print Release (PDF)

Complete CCRSI data set accompanying this release

This month's CoStar Commercial Repeat Sale Indices (CCRSI) provides the market's first look at commercial real estate pricing trends through January 2018. Based on 949 repeat sale pairs in January 2018 and more than 188,000 repeat sales since 1996, the CCRSI offers the broadest measure of commercial real estate repeat sales activity.

CCRSI National Results Highlights

-

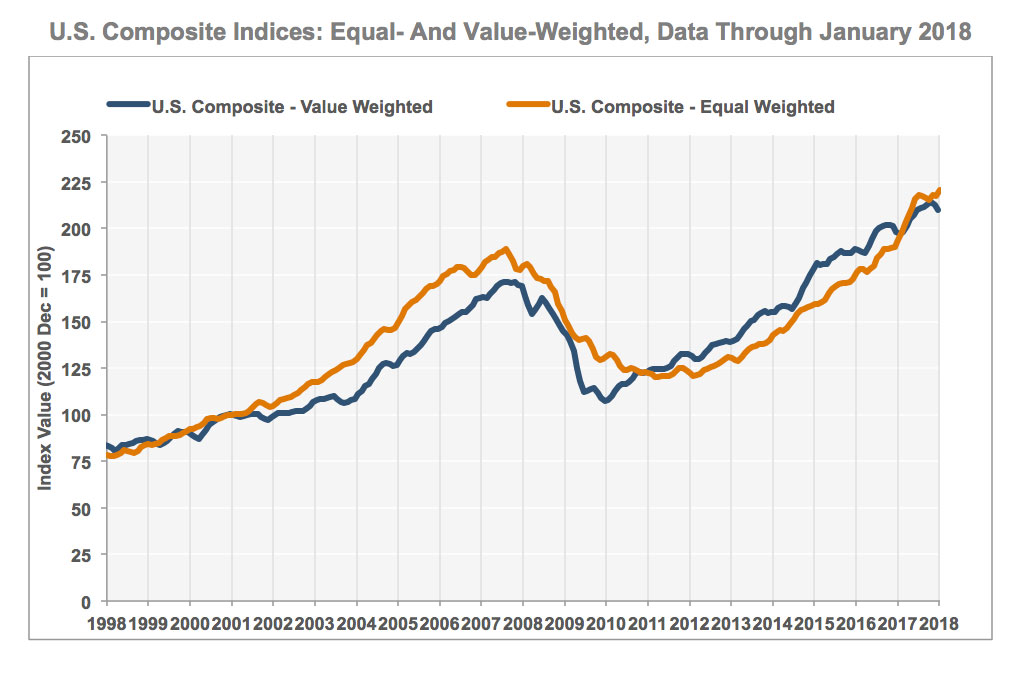

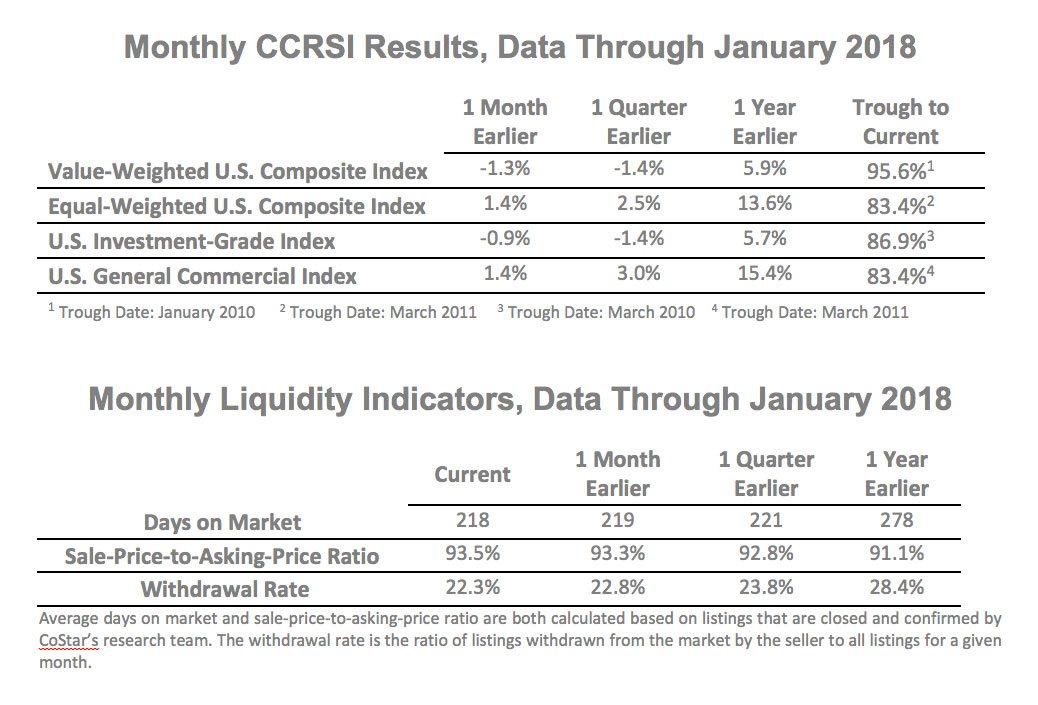

STEADY PRICE GROWTH FOR LOWER-PRICED ASSETS OFFSETS SLOWDOWN AT TOP END OF CRE MARKET. The equal-weighted U.S. Composite Index, which reflects the more-numerous but lower-priced property sales typical of secondary and tertiary markets, advanced by a stronger 1.4% in the month of January 2018 and 13.6% in the 12-month period ended in January 2018. Meanwhile, the value-weighted U.S. Composite Index, which reflects the larger-asset sales common in core markets, fell 1.3% in January 2018, while still posting an annual gain of 5.9% in the 12 months ended January 2018.

-

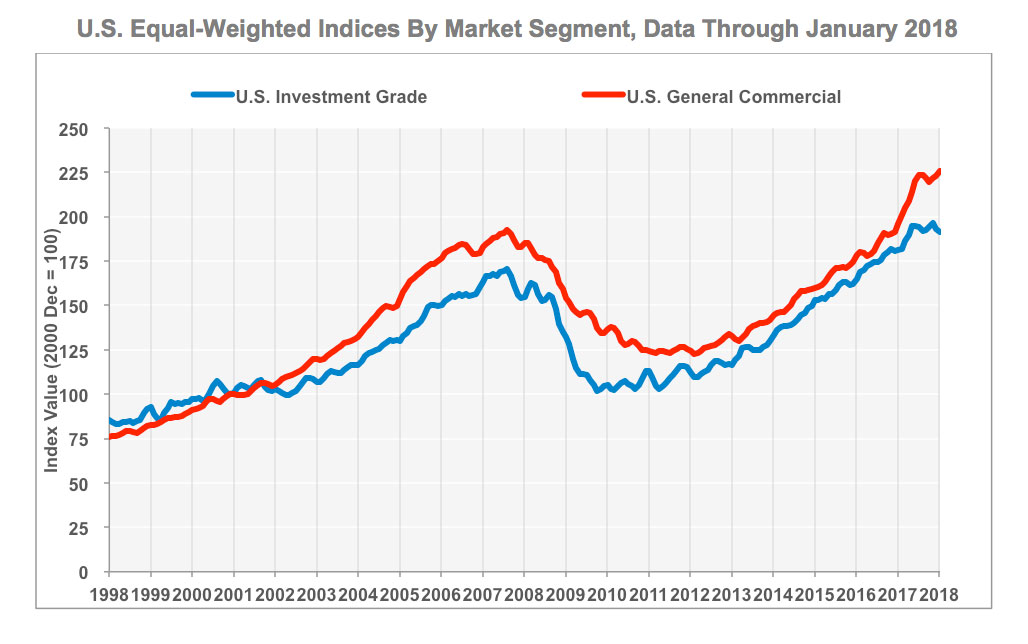

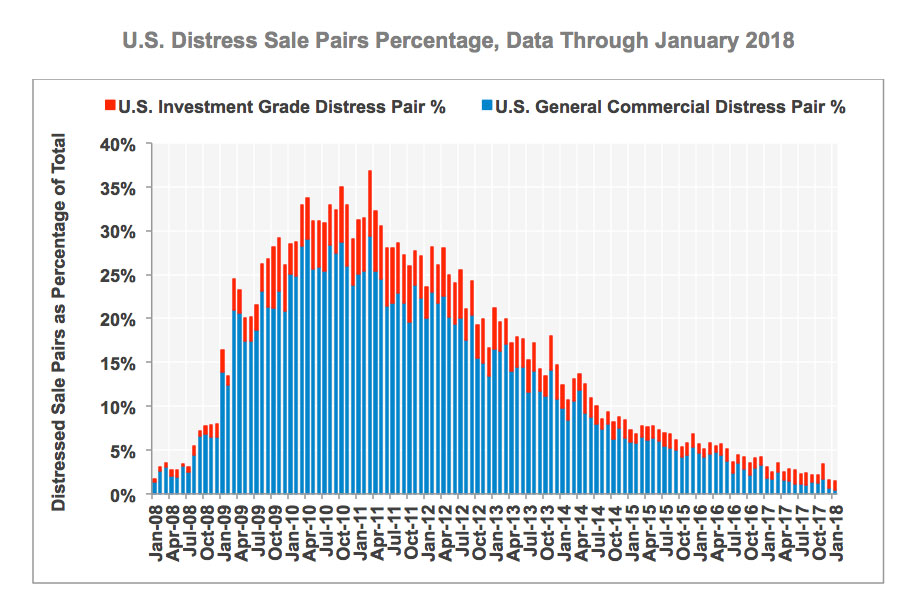

GENERAL COMMERCIAL PROPERTY SEGMENT SHOWED STRONGER MOMENTUM IN EQUAL-WEIGHTED INDEX. Recent pricing trends in the composite indices were mirrored in the two sub-indices of the equal-weighted Composite Index. The general commercial segment, which is influenced by smaller, lower-priced properties, increased 1.4% in January 2018 and 15.4% for the 12 months ended in January 2018. Meanwhile, the investment-grade segment of the index, which is influenced by higher-value properties, dipped by 0.9% in January 2018, but was up 5.7% in the 12 months ended in January 2018.

-

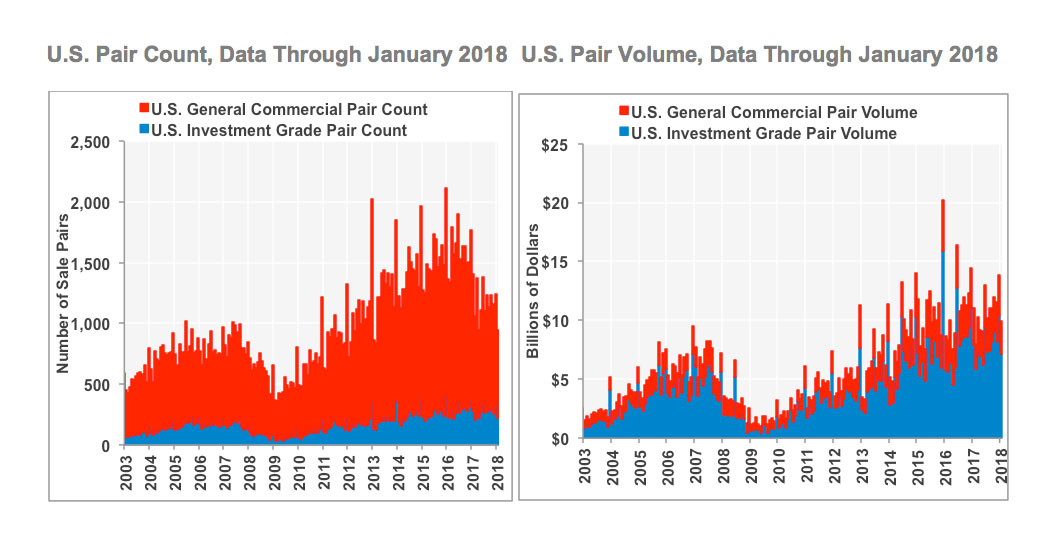

TRANSACTION VOLUME CONTINUED TO SLOW FROM RECENT PEAK YEARS. Composite pair volume of $129.1 billion in the 12 months ended in January 2018 was 4.0% lower than in the previous 12-month period ended in January 2017, continuing a trend since the market peak in 2015. As expected, composite pair volume in January 2018 was lower than the previous several months, a typical seasonal pattern as investors take a breather in January after the rush to close year-end deals.

-

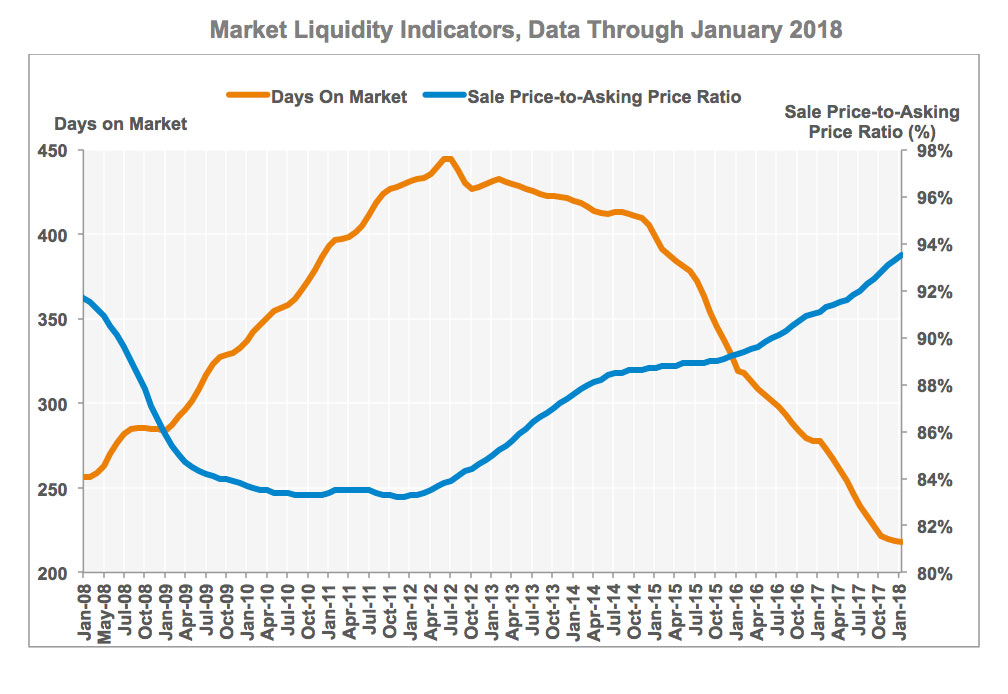

LIQUIDITY MEASURES REMAIN POSITIVE FOR BOTH BUYERS AND SELLERS. Average time on market for for-sale properties continued to decrease, dropping by 21.6% in the 12-month period ended in January 2018, and the sale-price-to-asking-price ratio further narrowed by 2.4 percentage points to 93.5%. Meanwhile, the share of properties withdrawn from the market by discouraged sellers receded by another six percentage points to 22.3% during the 12-month period ended in January 2018 compared to the 12-month period ended in January 2017.

About The CoStar Commercial Repeat-Sale Indices

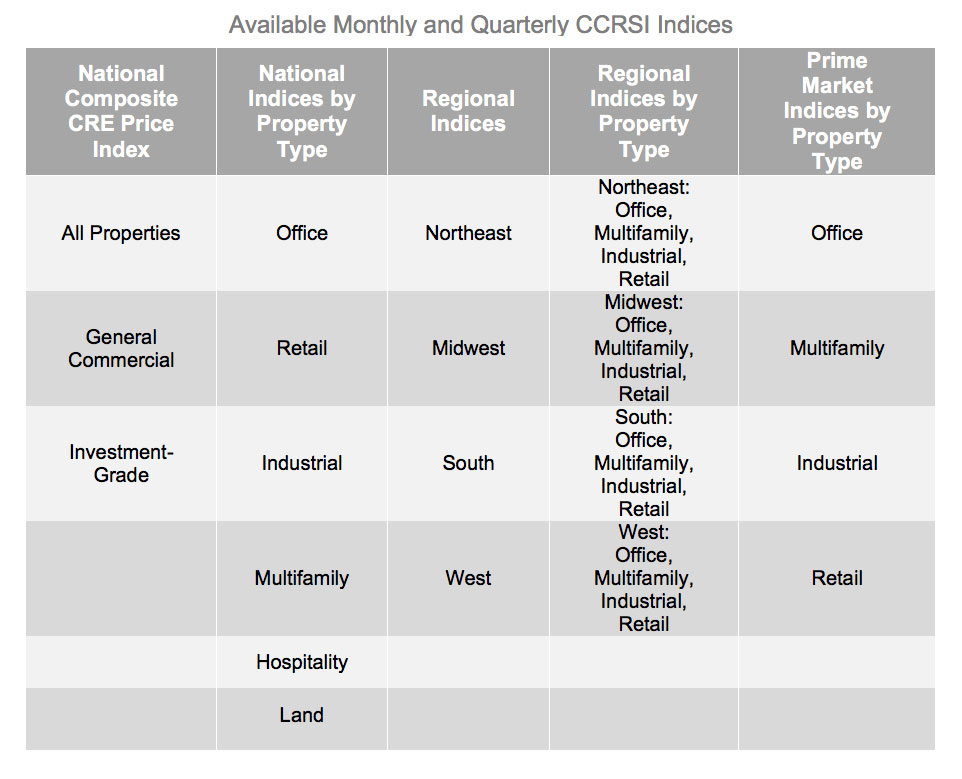

The CoStar Commercial Repeat-Sale Indices (CCRSI) is the most comprehensive and accurate measure of commercial real estate prices in the United States. In addition to the national Composite Index (presented in both equal-weighted and value-weighted versions), national Investment-Grade Index, and national General Commercial Index, which we report monthly, we report quarterly on 30 sub-indices in the CoStar index family. The sub-indices include breakdowns by property sector (office, industrial, retail, multifamily, hospitality, and land), by region of the country (Northeast, South, Midwest, and West), by transaction size and quality (general commercial, investment-grade), and by market size (composite index of the prime market areas in the country).

The CoStar indices are constructed using a repeat sales methodology, widely considered the most accurate measure of price changes for real estate. This methodology measures the movement in the prices of commercial properties by collecting data on actual transaction prices. When a property is sold more than once, a sales pair is created. The prices from the first and second sales are then used to calculate price movement for the property. The aggregated price changes from all of the sales pairs are used to create a price index.

MEDIA Contact:

Richard Simonelli, Vice President, Investor Relations (202) 346-6394 rsimonelli@costar.com.

For more information about the CCRSI Indices, including the full accompanying data set and research methodology, legal notices and disclaimer, please visit http://www.costargroup.com/costar-news/ccrsi.

About CoStar Group, Inc.

CoStar Group, Inc. (NASDAQ: CSGP) is the leading provider of commercial real estate information, analytics and online marketplaces. Founded in 1987, CoStar conducts expansive, ongoing research to produce and maintain the largest and most comprehensive database of commercial real estate information. Our suite of online services enables clients to analyze, interpret and gain unmatched insight on commercial property values, market conditions and current availabilities. LoopNet is the most heavily trafficked commercial real estate marketplace online with over 5 million monthly unique visitors per month. Apartments.com, ApartmentFinder.com, ForRent.com, ApartmentHomeLiving.com, Westside Rentals, AFTER55.com, CorporateHousing.com, ForRentUniversity.com and Apartamentos.com form the premier online apartment resource for renters seeking great apartment homes and provide property managers and owners a proven platform for marketing their properties. CoStar Group's websites attracted an average of approximately 34 million unique monthly visitors in aggregate throughout 2017. Headquartered in Washington, DC, CoStar maintains offices throughout the U.S. and in Europe and Canada with a staff of over 3,700 worldwide, including the industry's largest professional research organization. For more information, visit www.costargroup.com.